LET'S GO GREAT, TOGETHER

As we navigate through the aftermath of the unprecedented challenges posed by the pandemic and the devastating 100-year flood in Michigan’s Great Lakes Bay Region, we are pleased to present to you our strategic plan for the coming years. This plan outlines our vision, goals, and strategies to rebuild, adapt, and thrive in the post-pandemic and post-flood era.

First and foremost, we would like to express our heartfelt gratitude to you all for your unwavering support, leadership, and the roles you each played during these trying times. The guidance we received from our fellow community partners has been instrumental in helping us weather the storm and emerge stronger than ever before. Together, we have demonstrated resilience, resourcefulness, and an unwavering commitment to our mission.

The strategic plan we present today has been carefully formulated to address the unique challenges and opportunities that lie ahead. It is a blueprint for our organization’s growth, sustainability, and impact in the years to come. Our plan is centered around three key pillars:

1. Rebuilding and Recovery: In the aftermath of the pandemic and the devastating flood, our immediate focus was on rebuilding our infrastructure, restoring our operations, and supporting our community. We worked closely with local authorities, partners, and stakeholders to ensure a smooth transition throughout 2022 and 2023. Our primary goal was to create a safe and conducive environment for our employees, customers, and the community at large. Recovery continues with our focus being to welcome back overnight visitors to our region.

2. Adaptation and Innovation: The pandemic has forced us to reevaluate our strategies, processes, and models. We have learned valuable lessons about the importance of agility, digital transformation, and remote capabilities. Moving forward, we will invest in technology, training, and infrastructure to enhance our capabilities, streamline our operations, and embrace innovative solutions. This will enable us to adapt to changing circumstances, improve efficiency, and deliver exceptional customer experiences.

3. Growth and Expansion: While our immediate focus was on recovery and adaptation, we are committed to our long-term growth and expansion plans. We will seize opportunities to expand our market presence, diversify our revenue streams, and explore new partnerships. We will also invest in research and development to stay ahead of emerging trends, anticipate customer needs, and develop innovative products and services.

To support the successful implementation of our strategic plan, we will establish cross-functional teams, assign clear responsibilities, and track progress against key performance indicators. Regular communication and collaboration will be key to ensuring alignment, accountability, and continuous improvement.

In conclusion, we are confident that our strategic plan will guide us towards a brighter future. Together, we will overcome the challenges posed by the pandemic and the flood, adapt to the evolving landscape, and rebuild stronger than ever. We remain grateful for your ongoing support and look forward to working closely with you to achieve our vision.

Thank you once again for your unwavering dedication to Michigan’s Great Lakes Bay Region’s travel sector.

Yours in hospitality,

Annette M. Rummel, Ph.D.

CEO + Tourism Trailblazer

EXECUTIVE SUMMARY

Michigan's Great Lakes Bay Regional Convention and Visitors Bureau (MGLBRCVB) continues to support its regional and industry partners in recovering from the impacts of the global COVID-19 pandemic and the 100-year flood by restoring consumer confidence and building a more resilient visitor economy. To support these efforts, the MGLBRCVB undertook strategic planning to guide the efforts with a clear and data-driven approach.

As a result of the research, stakeholder and resident engagement, and economic forecasting, the strategies for MGLBRCVB are outlined below, with periods of activity indicated by shaded areas on the implementation charts.

STRATEGY #1:

Create a collaborative brand identity that reflects Michigan’s Great Lakes Bay Region (MGLBR)

To expedite recovery in MGLBR, a strong brand identity is needed that reflects the region's values, articulates what MGLBR is and what visitors can expect.

STRATEGY #2:

Develop MGLBR as a more desirable destination for visitors

Continuing to develop the destination and its assets will support continued recovery and the ongoing strength of the visitor economy by developing experiences, supporting business development, and growing the offerings of MGLBR.

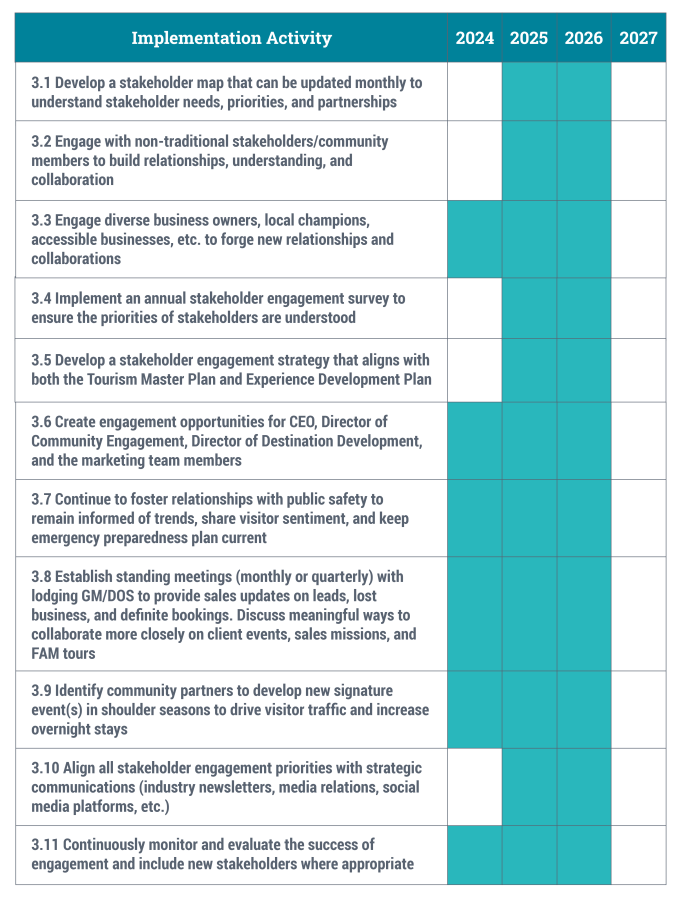

STRATEGY #3:

Adopt a comprehensive and inclusive stakeholder engagement focus

By engaging stakeholders in a meaningful and ongoing manner that emphasizes collaboration, engagement, and partnership, MGLBRCVB’s team will be able to share the impacts of the visitor economy and continue to grow it with traditional and non-traditional partners. This focused, collaborative engagement will support recovery and the long-term health of the destination.

STRATEGY #4:

Build the capacity of the internal MGLBRCVB team

For MGLBR to recover and grow, MGLBRCVB’s team will need to adapt to the new environment and support the industry in doing the same. Expanding the organization's capacity will also allow for diversity, equity, inclusion, and belonging to become a more significant focus, which will support the region in attracting new audiences.

STRATEGY #5:

Support industry capacity building

As the industry recovers from the impacts of the pandemic, it is important for MGLBRCVB’s team to lead, guide, and support industry partners in both adapting to the “new normal” and developing ongoing practices and approaches that address reduced workforce, inclusion, and sustainability among other things.

STRATEGY #6:

Grow the visitor economy through event and business attraction opportunities

One of the first sectors to return to pre-pandemic levels was the events sector. The leisure market and sporting events have experienced strong growth with business meetings slowly recovering. In addition, Great Lakes Cruising is poised for another record-breaking season. Eight cruise lines are expected to generate 170,000 passenger visits with several new vessels under construction, increasing competition between ports and creating the need for cruise lines to expand itineraries and new ports of call. 2024-2025 is the ideal time to capitalize on this growing travel segment. MGLBR has an opportunity to strategically capitalize on these markets to expedite the industry's recovery.

RECENT FACTORS IMPACTING THE VISITOR ECONOMY IN MICHIGAN'S GREAT LAKES BAY REGION

Michigan's Great Lakes Bay Region (MGLBR) continues to feel the residual impact of the COVID-19 pandemic and the 100-year flood with the loss of both Sanford and Wixom Lakes.

While significant progress has been made toward recovery, this plan focuses on the destination’s efforts to overcome massive disruption caused by these catastrophes.

Research outlines the region’s strong reliance upon drawing visitors from within Michigan. A targeted campaign aimed at Michigan residents will continue building the visitor-base from within the state. Customized messaging focused on out-of-state visitors will expand market development opportunities spurring future growth.

Recent Visitors: Visited a destination within 3 years at the time the respondent were surveyed.

*MGLBR: Respondent is classified as a recent visitor for at least one MGLBR community.

**Out-of-State proportions exclude Canada due to the small sample in the study conducted in 2018.

- When comparing the proportions of recent visitors from 2018 to 2022, we can see the effects of the COVID-19 pandemic.

- The reduction in recent visitors is strongest among Michigan residents, which MGLBR community is more dependent on than key competitors.

- Traverse City was the only destination not to see a decrease in out-of-state visitation.

- MGLBR saw just a slight decrease in out-of-state visitors in 2022.

ASSESSING THE IMPACT OF COVID-19 AND THE 100-YEAR FLOOD ON THE LOCAL TOURISM ECONOMY

Overall, most visitors rank their post-COVID-19 and the 100-year flood experience in the region as positive or unchanged. This trend presents an opportunity to build upon positive sentiment and build momentum through user-generated content and earned media focused on the region’s resilience.

COVID-19 AND THE 100-YEAR FLOOD AND THE DESTINATION EXPERIENCE

How does the visitor experience compare prior to the COVID-19 pandemic and the 100-Year Flood?

*Q: Based on what you know about each Michigan destination, how do you think today's visitor experience compares prior to the COVID-19 pandemic and the 100-year flood?

The Covid-19 pandemic and the 100-year flood has not significantly impacted perceptions of visitor experiences.

- The pandemic has undoubtedly affected travel. For MGLBR and most of their key competitors, many people were either positive or neutral when asked about changes in their experience at each destination.

- Saginaw and especially Detroit were more negatively impacted than other destinations.

- Chesaning, Midland, and Bay City had the most positive change in perception.

Economic indicators continue to show signs of improvement across most sectors. While ADR and RevPar have rebounded, occupancy has yet to achieve pre-Covid-19 pandemic and 100-year flood levels. However, lodging tax collections have exceeded pre-Covid-19 pandemic and 100-year flood levels due to rate increases. The hospitality and leisure workforce shows signs of improving year-over-year, yet with 12,500 people working in the tourism industry, it remains more than nine percent behind 2019 employment figures. Despite these challenges, implementing data-driven strategies for growth will drive the visitor economy to a full recovery.

MARKET AWARENESS

Market analysis identified opportunities to enhance destination awareness, develop new audiences by building upon the familiarity of communities within the region, and leveraging to create a greater awareness of lesser-known portions of the area. Highlighting the distinct differences between each community will appeal to a broader audience and assist with creating a more diverse visitor base.

- MGLBR communities are generally less familiar to visitors than their competitors.

- Frankenmuth is more familiar than Holland and within a few percentage points of Traverse City. This suggests that Frankenmuth can anchor attraction to the region.

Website analytics reinforce these findings with top-ranked searches centered around unique experiences such as the nation’s longest canopy walk, events, and outdoor recreation. Data indicates that website and social media audiences continue to increase year-over-year, but engagement has declined. This trend reflects a significant opportunity to tell captivating stories that feature authentic experiences unique to each community. Targeting itineraries and trip planning tools to capitalize upon well-known attractions, while showcasing “hidden gems”, will introduce these original experiences to repeat visitors and new audiences alike.

Markets are defined as the following:

Michigan: Detroit, Grand Rapids, Flint, Lansing, and other Michigan destinations.

Secondary: Chicago, IL; Toledo, OH; and Ft. Wayne, IN.

Prospective: Indianapolis, IN; Columbus, OH; and Cleveland, OH.

Canadian: London, ON, and Hamilton, ON.

- The table shows the percentage of respondents that are somewhat or very familiar with each destination by origin market.

- All MGLBR communities have higher familiarity with Michigan.

- Frankenmuth is very competitive within the state and only trails Detroit. Birch Run is also competitive in Michigan.

- Familiarity with Frankenmuth dips below Saginaw in Secondary Markets. This suggests that Saginaw could anchor attraction to the area for these markets, or there is an opportunity to enhance recognition of Frankenmuth and drive appeal.

The region is well-positioned to leverage the drive market within Michigan and surrounding states. Customized messaging tailored to visitors based on their market and demographic will require specialized content. Michigan residents are most familiar with the region while Canadians and out-of-state visitors will need more detailed information to inspire travel.

COMPETITIVE DIFFERENTIATORS

Access to Water

The region is perfectly positioned between Lake Huron, Saginaw Bay, and multiple rivers to provide memorable experiences. River access is ideal for kayaking, stand-up paddleboarding (SUP), and miles of scenic waterfront trails. The region is home to the United States’ largest contiguous freshwater coastal wetland system. The serene waters of Saginaw Bay are ideal for welcoming Great Lakes Cruises, sightseeing cruises, hands-on Tall Ship excursions, and charter fishing. In addition, the Shiawassee National Wildlife Refuge features an abundance of wildlife and birding in a natural setting. These soft adventures allow visitors with mobility or neuro-sensitivity issues to enjoy the outdoors and make lifelong memories.

Proximity to Population

The drive market remains a primary focus for promotion and MGLBR is uniquely positioned to capitalize on accessibility to major metropolitan hubs. Proximity to first-tier cities, such as Detroit and Toronto, provides a significant base of visitors with diverse interests to draw from. Grand Rapids and Toledo offer second-tier markets within a few hours’ drive. Touting an easy journey as part of the adventure sets MGLBR apart from the competition.

Unexpected Experiences

Perceptions of the region are neutral or positive, primarily due to a lack of familiarity with the amenities and experiences available for visitors. Opportunities to share the diverse attributes of each community through storytelling serve to inform visitors, inspire travel to the destination, and distinguish their identities within the region. Engaging visitors to share unexpected moments or capture their favorite experiences generates a library of user-generated content with authentic messaging that will resonate with followers. Utilizing influencers and travel writers will further expand reach to broader audiences.

Keen on Cannabis

Until federal legislation exists, Michigan and MGLBR stand to benefit from the growing popularity surrounding cannabis tourism. Neighboring Ohio legalized possession of small amounts of marijuana, but recreational use is still prohibited, and Indiana is currently exploring the possibility of legalization, but statutes prohibit possession, which provides an opportunity for promoting local access and responsible consumption to this niche market. This differentiator reinforces proximity as a distinction for MGLBR.

Access to Agriculture

The agricultural sector threads its way throughout MGLBR, offering ample opportunities to showcase experiences such as farm-to-table dining, hands-on harvesting, educational tourism, farmers markets, farm visits, roadside markets, U-Pick operations, corn mazes, cider mills, petting farms, on-farm retail such as dairies, creameries, woolen goods, etc.

Voluntourism

This desire for one-of-a-kind voluntourism and experiential travel is anticipated to continue rising well into the future. The MGLBRCVB’s Meetings and Conference and Motorcoach departments can easily benefit by showcasing the available opportunities.

Affordable Options

Increasing costs of goods and inflation are impacting future travel bookings. However, MGLBR stands out as an affordable destination, particularly when compared with other Michigan communities where lodging, dining, and attractions are significantly more expensive. Visitors from larger cities or Canada will find the significant cost savings appealing. Venue pricing and catering services for meetings, conventions, and sports competitions could also be enticed with the ability to stretch their budgets further.

Cruising

Expanding partnerships with Cruise the Great Lakes to include the region as a port of call will bring significant benefits, including media events, direct access to cruise lines, enhanced social media presence, and promotion through the Cruise Lines International Association (CLIA). Bay City has the required infrastructure to accommodate cruise ships. The opportunity to develop unique, experiential shore excursions to provide cruise lines with fresh itinerary options will expand this as a differentiator for the region.

DIFFERENTIATORS UNIQUE TO MGLBR

Frankenmuth

Frankenmuth is the region’s greatest differentiator, with dozens of annual festivals, hundreds of events, Bavarian-style architecture, family-friendly accommodations, and the world’s largest year-round Christmas store.

Santa House

The Santa House is a strong seasonal attraction that welcomes visitors to meet Santa and tour his workshop.

Midland Canopy Walk at Dow Gardens

The Midland Canopy Walk at Dow Gardens is the longest Canopy Walk in the United States and is a draw for outdoor enthusiasts and birders. Accessible for all ages, abilities, and open in every season.

Dow

Dow’s global headquarters bring business travel, investment, and awareness to MGLBR.

Sister City Relationships

Saginaw has a well-established Sister City relationship with Tokushima, Japan, that has resulted in several unique experiences, including the Japanese Cultural Center and one of the most authentic Japanese tea houses in North America. Saginaw’s additional Sister City relationships are Amanokrom, Ghana & Zapopan, Mexico. Additional regional Sister City relationships include Bay City with Ansbach, Germany & Goderich, Canada. Midland with Handa, Japan, and Frankenmuth’s relationship with Gunzenhausen, Germany, which has been ongoing since 1962.

CONCLUSION

To further stand out in a competitive landscape in Michigan, the United States, and globally, MGLBR must continue to find differentiators in products and experiences that will give visitors compelling reasons to visit. The Sister City Relationships offer this opportunity.

RESIDENT SENTIMENT

Tourism is a positive aspect of MGLBR. With 66 percent of residents agreeing that tourism is good for the area, tourism promotion is a good use of money, and marketing the region is generally a good idea and will result in increases of customers to local businesses. Residents want and desire more respectful visitors who care for natural resources, travel with family, and will welcome them even in the peak summer season.

Residents view their region as being naturally scenic, defined by bodies of water, and ideal for families. They would prefer visitors who respect nature and share these values.

ATTRACTION PARTICIPATION IMPACT ON COMMUNITY ATTITUDES

- Residents with high rates of attraction participation give higher ratings to the community as a place to live, and they report higher levels of pride

- They are also much more likely to rate the region as a good place to visit and recommend visiting the Great Lakes Bay to friends and family

- These are compelling reasons to encourage community residents to participate in area attractions

PREFERRED VISITORS

Every type of visitor is seen as a positive for the community. Residents think that more tourism is good for the community, and seasonality (shown below) is not a concern.

To generate tourism that is positive for the area, the focus should be on...

ORGANIZATIONAL CONSIDERATIONS

MGLBRCVB’s team, led by CEO Annette Rummel, has traditionally followed a flat structure, allowing the team to be nimble, react and respond quickly to opportunities and challenges, including the COVID-19 pandemic and the 100-year flood.

The strength and capabilities of the MGLBRCVB’s team are a significant asset to the organization and the industry in the MGLBR. Appropriately, the team redirected much of its focus to responding to the COVID-19 pandemic and the 100-year flood, and unfortunately had to downsize to stay afloat. Now, to fully recover and effectively respond to the changed needs of the industry and visitors, new organizational roles are recommended. These roles will broaden the bandwidth of the existing team, bring new skills to the organization, and prepare the MGLBRCVB’s team for the implementation of this Strategic Plan and the future Tourism Master and Experience Development Plans.

These roles include a Destination Development Manager, a Community Engagement Manager, and a Corporate / Industry Communications Coordinator.

The Destination Development Manager will be responsible for championing the implementation of the upcoming Tourism Master Plan and Experience Development Plan, collaborating with community partners in ensuring the plans are enacted, progress is tracked, and success is measured. The ideal candidate will have a great level of trust among influential community members who have the authority to move destination development initiatives forward.

The Communication Engagement Manager will also have a high degree of respect and trust in the community and will work closely with the Destination Development Manager and the Marketing team. This role will be responsible for making connections within the industry, community, and organization, being an ambassador for the organization among stakeholders, expanding the reach of the organization to include non-traditional and diverse audiences and ensuring the internal GLBRCVB team is collaborating with the industry effectively.

Finally, the Corporate / Industry Communications Coordinator will be responsible for effectively communicating with the industry, community stakeholders, government partners and media on a regular basis about the organization, its progress against key initiatives and how it is supporting the industry and the community. These communication channels may include newsletters, townhall meetings, media releases, progress reports, etc. and must be fully integrated with all aspects of the organization.

Until the recommended roles are filled, the CEO will assume oversight and responsibility for the strategic initiatives that will be tasked to these portfolios.

FORECASTING THE FUTURE OF ECONOMIC RECOVERY

To develop our forecast for the future of economic recovery in MGLBR, we analyzed several different trends, including consumer travel sentiment and travel priorities. We reviewed hotel room revenue performance, air travel trends, and international travel forecasting. Finally, we included an analysis of job openings in the leisure and hospitality sector to ensure that we can make informed predictions.

According to Smith Travel Research, hotel occupancy is more evenly distributed across the MGLBR than ever before; however, variances exist in average daily rate (ADR) depending upon location.

For the first time since the pandemic, revenue per available room (RevPAR) exceeded 2019 levels (+1.2%) and lodging tax is outpacing previous record-setting collections due to a 7% growth in ADR.

Opportunities for collaborating with hotel partners to attract additional group business, expanding promotion into new niche markets, and growing special events in off-peak seasons will continue the momentum of recovery within the lodging sector.

Meanwhile, air capacity remains a challenge across the state, with most destinations struggling to regain pre-pandemic passenger volume with Midland Bay Saginaw International Airport (MBS) recovering to 83% of 2019 levels (residents and visitors).

The ongoing pilot shortage has resulted in additional schedule reductions at MBS, but visitor arrivals, excluding residents, rebounded to 54% of 2019 levels in January 2023.

The MGLBRCVB team could collaborate with MBS to pursue an additional carrier or expand service through an existing carrier by applying for a U.S. Department of Transportation Small Community Air Service Development Grant (SCASD) and creating a “fly local” campaign, encouraging residents and local businesses to prioritize utilizing MBS.

Inbound data for 2022 shows international’s share of visitor arrivals is on par with 2019 levels. Chicago ranks #1 among domestic markets, followed by Detroit and New York, with Detroit increasing its share from 2% in 2019 to 7.1% in 2022.

International travel forecasts from Tourism Economics indicate this sector will take longer to recover. Pre-pandemic spending levels will be achieved by 2024 with anticipated visitation to Michigan reaching this goal in 2025.

While a weaker dollar and unfavorable exchange rates pose a threat, 2022 showed great promise with a strong recovery from Canada and Western Europe.

China and the Asia Pacific region have been the slowest to bounce back but are expected to make notable improvements in 2023 as travel restrictions loosen.

Nationwide, statistics from Haver Analytics reflect more than two job openings exist for each unemployed person. Despite this, the leisure and hospitality industry has seen more than 20% wage growth since 2019. The tourism industry is particularly hard hit by workforce shortages in restaurants and accommodations, with 1 in 9 jobs remaining unfilled.

Communities within MGLBR have been impacted to varying degrees across the region compared to the rest of the state. This suggests opportunities for the MGLBRCVB team to collaborate with economic development to brand the region as an ideal location to work, live, and play.

FORECASTING THE FUTURE

MBS, Detroit, and Flint Airport data were used to study airline forecasting. We sought to understand routes, timing, and carriers. We also studied how to partner with MBS to draw additional visitors to MGLBR. Working with hotel and accommodation partners to understand their forecast models, booking cycles, and needs periods also provides valuable insight in the near term.

As a regional destination, we understand that weather plays an important role in visitors' decision-making. By monitoring weather conditions and forecasts, the MGLBCVB team can support partners to adapt programming, marketing, and social media messaging based on fair or unfavorable weather conditions.

7 OBJECTIVES + STRATEGIES

Objective 1 - Strategies to restore the confidence of residents and visitors

To ensure continued recovery and support the growth and development of the region, we have outlined strategies that can be implemented to restore the confidence of both residents and visitors.

The first step in this process is to create a collaborative brand identity that reflects the region. We must build a strong brand identity that reflects the region's values, articulating what MGLBR is and what visitors can expect. By working with stakeholders, residents, community leaders, and industry partners, we can craft a regional brand to convey a sense of place that resonates with those who live here and those who visit.

We must adopt a comprehensive and inclusive stakeholder engagement focus. To be successful, we will work to gain the trust and support of our community and the residents of our area. Developing relationships with stakeholders, diverse communities, and partners will allow us to understand their needs and priorities. This focused, collaborative engagement supports recovery and the long-term health of the destination.

To encourage visitors to explore the area, we recommend developing MGLBR as a more desirable destination for visitors. The Tourism Master Plan and the Experience Development Plan will provide the framework to strengthen the visitor economy by building assets, supporting business development, and establishing communication that entices visitors to discover the growing offerings of the region.

Creating a collaborative brand identity is the highest priority and should be implemented fully to complete this process by the end of 2025. A consistent brand experience will positively impact visitors' perceptions and give the community something positive to rally around. Adopting a comprehensive and inclusive stakeholder engagement focus should begin immediately and be ongoing. Additionally, efforts must be put forth to ensure progress toward industry engagement and participation in destination development. Partial implementation should be achieved by the end of 2024. Developing MGLBR as a more desirable destination will be a long-range effort. It should also be included in the destination and experience development plans that will be implemented following the completion of this recovery strategy and into the future.

Objective 2 - Rally stakeholders to participate and engage in support of recovery efforts

Gaining the support of stakeholders is an important part of our recovery plan. Focused and collaborative engagement will encourage recovery and improve the long-term health of MGLBR.

We have crafted a strategy to adopt a comprehensive and inclusive stakeholder engagement focus for MGLBRCVB’s team. An approach that emphasizes ongoing collaboration, engagement, and partnership will allow us to share the impacts of the visitor economy and continue to grow it with traditional and non-traditional partners. We will seek input from diverse communities and contacts in public safety and businesses throughout MGLBR to fully understand stakeholder needs and priorities. Fostering relationships with community members through outreach and regular meetings, along with a comprehensive communication plan, will strengthen the bond between stakeholders, the MGLBRCVB team, and the entire community.

Adopting this strategic focus will result in many tangible benefits including industry engagement and participation in destination development. Work to implement this focus should begin immediately with a goal of partial implementation by the end of 2024, partnered with an ongoing effort and the key performance metrics identified.

Objective 3 - Rebuild industry capabilities

Our plan includes a strategy focused on rebuilding industry capabilities to support the overall recovery of MGLBR.

As the industry recovers, MGLBRCVB’s team must lead, guide, and support our partners to adapt to the current environment. We are committed to supporting industry capacity building with a comprehensive approach. By offering training opportunities and development programs for Diversity, Equity, Inclusion, and Belonging (DEIB), as well as sustainability and stewardship, we can establish best practices, encourage growth, and work collaboratively to strengthen the industry.

Workforce development will be crucial as businesses face the challenges of a reduced workforce and strive to improve in the areas of inclusion and sustainability. We plan to implement partnerships with higher education, businesses, and economic development agencies to create training and incentive programs that can support and guide our industry partners.

To demonstrate commitment to the industry, consideration should be given to add the position of manager of Community Engagement to the MGLBRCVB’s team. The goal of this position would be to achieve full implementation of this strategy by the end of 2025.

Objective 4 - Identify opportunities amid the current situation

To craft our strategy, we evaluated data, observed trends, and analyzed reporting so that we could identify key opportunities for growth amid the current situation. Based on our analysis, MGLBR can strategically grow the visitor economy by increasing leisure travel through festival and event offerings, sports competitions, and meetings and conferences attraction opportunities.

Festivals and events were the two the top sectors to return to pre-pandemic level. A strong demand for leisure travelers who attend and participate in festivals and events and sporting competitions now exists. Business meetings and conferences continue to lag in recovery; however, this market segment is expected to experience incremental growth in the future.

An updated leisure traveler strategy that focuses on festivals and events attendance and participation will reveal opportunities, provide a framework for collaboration, guide development to expand into new areas, and increase engagement within the community.

An updated sports attraction strategy will reveal these same opportunities.

An updated meetings and conferences attraction strategy will incorporate strong alignment and partnership with corporate and community stakeholders. Working closely within the community to build connections between business professionals, economic development organizations, and education partners will create an opportunity to strategically capitalize on this market to expedite the industry’s recovery in a collaborative way.

To demonstrate commitment to the industry, these strategies should be deployed by 2024.

Objective 5 - Identify opportunities amid the current situation

Focus should be placed on diversity, equity, inclusion, and belonging (DEIB) when building the capacity of the MGLBRCVB team. DEIB training for all staff and updating internal practices will ensure that the entire team authentically understands the gaps, barriers, opportunities, and successes in the region.

Capacity building for MGLBRCVB’s team should begin with the recruitment of a Destination Development Manager and a Community Engagement Manager in 2024. These leadership positions will also serve to support industry capacity building, which is critical to the success of this portion of our plan. Full implementation should be achieved by the end of 2025.

As partners in our community, we will support industry capacity building to extend our commitment to DEIB. We plan to offer training and development opportunities to industry partners and stakeholders that give guidance and help establish best practices throughout the region.

Objective 6 - Identify opportunities to embrace and build upon our diversity

In addition to providing a plan for strategic growth and recovery, this plan also identifies opportunities to embrace and build upon our stakeholder engagement efforts.

We plan to reach out to non-traditional and diverse stakeholders for input and guidance as we work to create a collaborative brand identity that reflects MGLBR. To ensure continued support, we will adopt a comprehensive and inclusive stakeholder engagement focus to remain in contact with non-traditional stakeholders/community members to build relationships, understanding, and collaboration.

Consistent messaging, expectations, and awareness are critical. Brand identity development should begin immediately and be fully implemented by the end of 2024. Industry engagement and participation in destination development should start immediately and be ongoing throughout plan execution.

Objective 7 - Rally residents to participate and engage in support of recovery efforts

Carefully analyzing opportunities and infrastructure will allow us to develop a detailed strategy and build relationships with residents to support growth and development in these key areas. Careful planning and strategic action are necessary to develop MGLBR for residents. Insights gained when creating the Tourism Master Plan and the Experience Development Plan guide MGLBRCVB’s team, stakeholders, and the community to build an appealing, stronger, and resilient community.

The existing Champion and the regional Ambassador programs will be leveraged to rally residents to participate and engage in the support and promotion of the region.

STRATEGIC VISION: GO GREAT, TOGETHER

From 2016 to 2020, MGLBRCVB had a roadmap to guide its way to becoming a trailblazing DMMO of the future. In 2020, the region suffered the devastating effects of the COVID-19 pandemic and the 100-year flood. Overnight, travel stopped causing occupancy to drop off, businesses were forced to close, and strategic efforts were halted. The visitor economy was essentially closed.

The region has seen a modest recovery since the gradual reopening of the visitor economy. The focus of this five-year strategic plan is rooted in collaboration and partnership. If the pandemic taught us anything, it’s that as a region we’re better together and we have the drive, capability, and community to emerge even better than before. Our Go Great Together was forged from this experience.

Several key themes that emerged included:

- Develop the destination, place brand, and experiences available

- Collaborate with industry and non-traditional stakeholders

- Grow the capacity and offerings of the organization to support industry in a post-pandemic and flood environment

- Include new and diverse audiences and demonstrate inclusion, accessibility, belonging, and environmental stewardship

STRATEGY #1:

Create a collaborative brand identity that reflects MGLBR

To expedite recovery in MGLBR, a strong brand identity is needed that reflects the region's values, articulates what Michigan's Great Lakes Bay Region is, and what visitors can expect.

STRATEGY #2:

Develop MGLBR as a more desirable destination for visitors

Continuing to develop the destination and its assets will support continued recovery and the ongoing strength of the visitor economy by developing experiences, supporting business development, and growing the offerings of the region.

STRATEGY #3:

Adopt a comprehensive and inclusive stakeholder engagement focus

By engaging stakeholders in a meaningful and ongoing manner that emphasizes collaboration, engagement, and partnership, MGLBRCVB’s team will be able to share the impacts of the visitor economy and continue to grow it with traditional and non-traditional partners. This focused, collaborative engagement will support recovery and the long-term health of the destination.

STRATEGY #4:

Build the capacity of the internal MGLBRCVB team

For the region to recover and grow, MGLBRCVB’s team will need to adapt to the new environment and support the industry in doing the same. Expanding the capacity of the organization will also allow for diversity, equity, inclusion, and belonging to become a more significant focus, which will support the region in attracting new audiences.

STRATEGY #5:

Support industry capacity building

As the industry recovers from the impacts of the COVID-19 pandemic and the 100-year flood, it is important for MGLBRCVB’s team to lead, guide, and support industry partners in both adapting to the “new normal” and developing ongoing practices and approaches that address reduced workforce, inclusion, and sustainability among other things.

Strategy #6:

Grow the visitor economy through event and business attraction opportunities

One of the first sectors to return to pre-pandemic levels was the events sector. Both leisure and sporting events have experienced strong demand and business meetings continue to grow. Go Great Lakes Bay has an opportunity to strategically capitalize on this market to expedite the industry's recovery collaboratively.

Key Performance Indicators

A key part of any recovery plan is establishing objective, measurable metrics to monitor and evaluate the recovery effort. The most commonly used KPIs today involve economic metrics (e.g. visitors, GDP contribution, employment, and tax impacts) and hotel performance metrics (e.g. occupancy rates, RevPar, average daily rates). There is a trend toward more KPIs around visitor satisfaction and resident sentiment.

Source: 2021 Futures Study, MMGY NextFactor & Destinations International

It is proposed that a combination of KPIs be used to track overall performance and recovery for Go Great Lakes Bay. These should include specific metrics in three broad categories: economic impact, hotel performance, and visitor satisfaction scores. The table below outlines the recommended approach.

PROPOSED STRATEGIC PLAN KPIs

ECONOMIC

- Total number of visitors

- Total economic impact

- Average length of stay

- Average daily spend

HOTEL

- Occupancy rate

- Revenue per available room (RevPar)

- Average daily rate (ADR)

VISITOR

- Visitor satisfaction score

- TripAdvisor ratings

SUGGESTED KPIs FOR EACH OF THE STRATEGIES

PRIORITIZATION OF ACTIVITIES

To ensure this strategy is successfully implemented, the strategic goals and subsequent actions must be prioritized to ensure the availability of resources to achieve them. The following prioritization is based on:

- Availability of resources within MGLBRCVB’s team;

- Potential for positive impact on MGLBRCVB;

- Potential to build momentum toward future actions;

- Potential for positive impact on the industry;

- Potential for positive impact on MGLBR;

- Alignment with strategic vision.

It is recommended that MGLBRCVB’s team approach the initiativesof this strategy in this order:

This project was made possible through the EDA Cares Act funding

Agritourism

Agritourism is a form of commercial enterprise that links agricultural production and/or processing with tourism to attract visitors onto a farm, ranch, or other agricultural business for the purposes of entertaining or educating the visitors while generating income for the farm, ranch, or business owner.

Voluntourism

Voluntourism is a combination of volunteering and tourism in which travelers participate in voluntary work, typically for charity, while visiting a destination.

A Long-Term Investment

Aiming to preserve the quality of life for our residents and ensure quality experiences for visitors, this plan will guide the long-term sustainable planning and design of Michigan’s Great Lakes Bay Region as a tourism destination.

Read More +

WHERE BRAND MEETS BUSINESS

Communications Strategy

Post-pandemic, our region has changed as a destination. This plan develops a strategy that outlines how our branding and messaging should adjust through an eventual and successful travel rebound.

The Power To Keep Growing

With a vision of becoming a welcoming and inclusive region that celebrates our four seasons, natural assets, distinct experiences, connectivity, and shared community values, four strategic goals related to Experience Development were identified for the region.

Read More +